Feature List

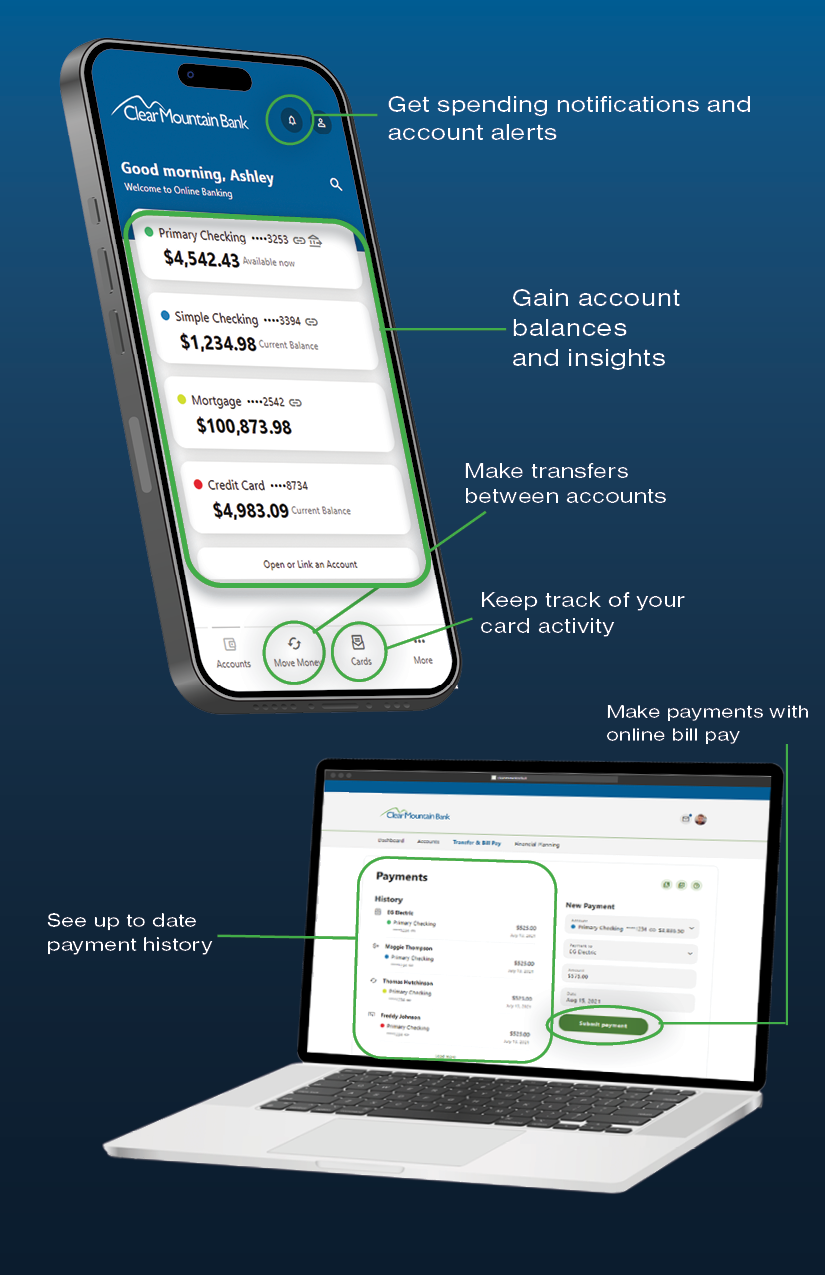

We are excited to showcase your new online and mobile banking experiences.

The reimagined platform is focused on your banking needs by making it easier for you to self-service from your smartphone, tablet, or computer.

Clear Mountain Bank’s intention when making this upgrade was to provide an elevated user experience that is personalized and intuitive. Now personal online banking (SmartLink) and business online banking (BizLink) will be combined into one single platform in both desktop and mobile app!

Check out the video below for some additional info!

Frequently Asked Questions

We’re excited to launch a new online banking and mobile banking experience for you! This change will provide an enhanced user experience for our personal and business online banking customers, as well as users of our mobile banking and business mobile banking apps.

Personal and business account holders that utilize any of the following products:

- SmartLink Online Banking

- BizLink Online Banking

- Mobile Banking

- Business Mobile Banking

We’re launching the new digital banking platform on October 7, 2025.

Yes. We anticipate that our online banking and mobile banking systems will be unavailable for use beginning on Friday, October 3, during the late evening hours. They will be available again when we launch the new platform on October 7th. During this system downtime, we are expanding our customer service center hours to assist you by phone with any questions that may arise. Expanded customer service hours will be Saturday, October 4, from 7am – 5pm. Our customer specialists can be reached by calling (304) 379-2265.

No. We will convert your existing login credentials to our new service, and it will walk you through a process to re-establish your password during your first login.

Yes, you will need to download our new app from your phone’s app store beginning on October 7th. We will make the links for our new mobile banking app available by September 26th.

Yes, you will still access online banking through our website at www.clearmountain.bank. However, the login URL will be changing on October 7th. If you have this URL saved or bookmarked for direct access, you’ll need to update your bookmark after October 7th.

The new system contains all of the existing features that you’re accustomed to using, as well as an updated user interface. It offers a more consistent user experience across both the online and mobile banking channels. For our customers that have both personal and business accounts, these accounts will now be housed within the same banking platform, so you’ll no longer need to access two separate systems to do your digital banking.

No. The online bill pay service isn’t changing, and all of your existing billers and payment schedules will be accessible in the new system.

No. Scheduled transfers and payments will carry over into the new system.

Yes. If you have scheduled or reoccurring transfers set up where the funds transfer to another financial institution, you will need to reestablish these transfers after logging in to our new online and mobile banking service.

Yes. After conversion, you will need to login to your account and reestablish all previous alerts. We also recommend all users visit the Alerts section (under Tools) in our new online and mobile banking after October 7th as there will be additional digital banking alerts that will become available to you.

In order to verify your login access to the new system, it’s important to make sure that we have updated and correct contact information for you on file. Check your banking records and if you find outdated contact information, please update it by:

- Logging into online banking (SmartLink or BizLink)

- Contacting us by phone at (304) 379-2265

- Visiting your local branch location

Yes, feel free to contact us at 304-379-2265.

Business Frequently Asked Questions

Yes. All sub-users on your account will transfer over to the new service.

There will be some impact on how you process payroll files. The bank will do its best to move as much information as possible to minimize impact and communicate with you to avoid any interruptions. If a need arises and you have an issue with your payroll, please contact us immediately.

If you have a payroll that will process during the scheduled downtime, please contact us ahead of time so that we can make sure that your payments process as expected.

No. While the look and feel of how a wire is submitted in the system will change, all premade templates will be converted to the new service.

No. The remote capture service isn’t changing and will have the same functionality and limit as you are accustomed to today.

Yes. Mobile deposit availability and limits will carry over to the new service. However, new functionality will become available after October 7th that allows for multiple checks to be deposited in a single mobile deposit transaction.

No. The business bill pay service isn’t changing, and all of your existing billers and payment schedules will be accessible in the new system.

No, existing Stop Payments will not be affected.

Yes, please see the informational page below.